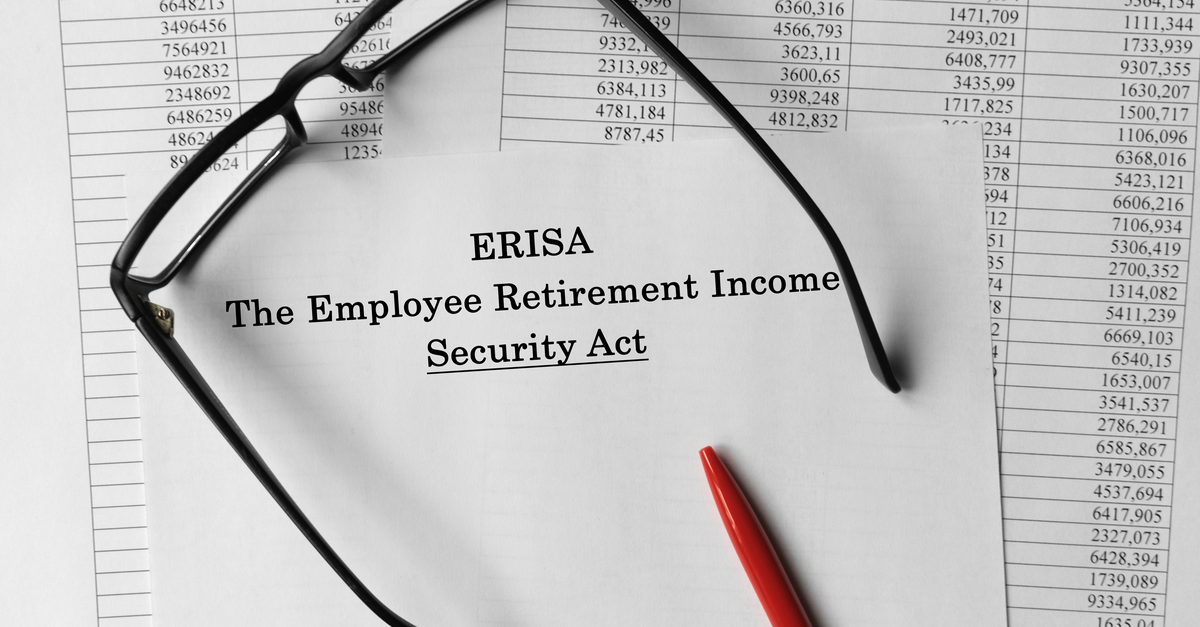

Most 401(k) retirement plans are governed by the Employment Retirement Act of 1979 (“ERISA”). If you are married and want to leave your retirement benefits to anyone other than your spouse, did you know the law may override your wishes?

Under § 1055 of ERISA, a surviving spouse is automatically entitled to at least half the benefits upon an owner’s death, regardless who the owner named as beneficiary. In Boggs v. Boggs, 520 U.S. 833 (1997), the Supreme Court explained the intent was to “ensure a stream of income to surviving spouses.” In order to leave these benefits to anyone else, the spouse must provide a waiver. A prenup will not suffice because the waiver must be executed during marriage.

This rule can create issues when an owner becomes widowed or divorced, changes the beneficiary to his or her children, and later remarries. Upon the owner’s death, at least half the assets will go to the new spouse. Mike Piershale, ChFC, published a real-life example of the consequences of this rule. He describes the late Mr. Kidder, who named his children as beneficiaries of a 401(k) account after he was widowed. He later remarried and died within six weeks. Despite Mr. Kidder naming his children as beneficiaries, the court ultimately awarded the assets to his second wife after a legal battle.

It is important to update beneficiary designations as needed and to seek assistance from an estate planning attorney to ensure benefits will be distributed as you intend upon your death. Please contact us if you have questions or need assistance with your estate plan.

Link to Article:

https://www.kiplinger.com/retirement/estate-planning/603421/you-could-accidentally-disinherit-your-children-unless-you-follow